Prospect Theory

Humans do not interpret a 100$ profit and 100$ loss in the same way. Losing 100$ feels more significant than gaining 100$.

Humans root for certainty. We forget that we are on top of a rock that rotates, and its physics is not fully understood with high certainty. The quality of every ounce of time on this planet is based on the level of perception toward one’s economic freedom. The fundamentals of behavioral economics are explained by this theory, invented by Daniel Kahneman, the author of the famous book Thinking Fast and Slow.

Essence

According to this theory,

Humans do not interpret a 100$ profit and 100$ loss similarly. Losing $100 feels more significant than gaining $100.

There is a huge literature on this, and Kahneman was awarded the Nobel Prize for his work, so I will try to explain to whatever extent I can do in this writing.

What is Prospect Theory?

Prospect Theory is constructed with two components

Value Function - How people value things

Weighting Function - How people deal with probabilities

To better understand prospect theory, we should start from the center of this graph, the Kink.

Kink

A psychological reference point from where you start measuring the economic value of anything. It can be today's wealth you possess, or it can be something else by which you frame the axis of comparison for any financial decision you make.

From a business perspective, we can exploit this point to sell something. Identify the small reference point that may spook people if there are any tiny changes to that point. Start selling something to ensure their safety around that reference point. A good example is insurance policies. People may purchase insurance to avoid the pain of potentially large losses, even if the probability of such a loss is small.

Fun Fact: Records exist that people purchased funeral insurance in ancient Rome 😂

Diminishing Marginal Utility

As gains increase, the additional value or satisfaction (utility) derived from each additional unit of gain decreases. This is known as diminishing marginal utility.

For example, gaining $100 when you have nothing feels more significant than gaining $100 when you already have $10,000.

Diminishing Sensitivity

As losses increase, each additional loss unit is perceived with less intensity. This means that the first loss hurts more than subsequent losses of the same size.

For example, losing the first $100 feels much worse than losing another $100 after already losing $1,000.

Weighting Function

You can tell someone the probability of something, but they can not fully comprehend it. Weighting function measures how people psychologically think about probabilities.

Humans will round to zero (impossible) for events with very low probabilities and round to one (certain) for events with high probabilities. The general population does not think in a continuum of probabilities.

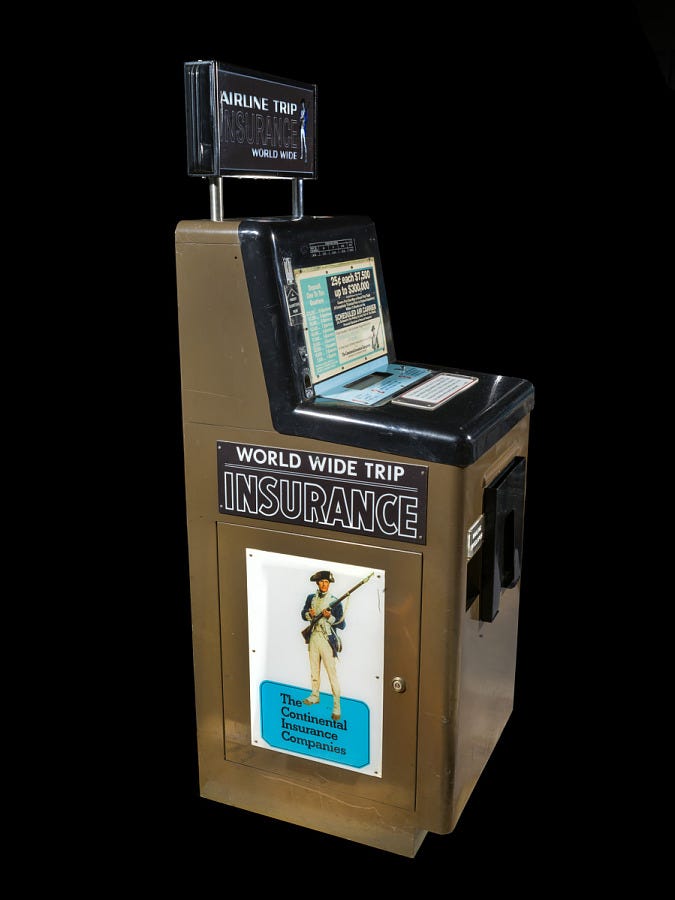

If people decide not to round a probability to zero or one, they exaggerate the difference between zero and one. From a business perspective, this is an easily exploitable crowd. If you get into an Airplane, the probability of you dying in a flight crash is something like 1 in 11 million, so most will write it off to zero, and there will be a section of the crowd who want some certainty in case of such havoc.

Insurance vendors in the 1950s and 1960s installed vending machines right at the flight boarding gates to ensure that one flight you will board.

Eventually, people will become aware of these sales tactics, and such businesses will slowly disappear. Prospect theory explains a lot of things that go on in behavioral finance but not everything.

Contrarian theories

Gerd Gigerenzer has strongly criticized Daniel Kahneman, arguing that heuristics should not lead us to believe that human thinking is biased. Instead, Gerd believes that we should think of rationality as an adaptive tool inconsistent with the rules of logic.